Latest

-

Mastering Peak Season Logistics: A Checklist for Supply Chain Professionals

The arrival of peak season logistics can be both an exciting and challenging time for supply chain professionals across various industries, including Automotive, Aerospace, Engineering, Manufacturing, Pharmaceuticals, and Healthcare. The surge in demand, increased competition, and potential supply chain disruptions…

-

How logistics is playing a critical role in automotive industry’s post-pandemic success

The last couple of years have been challenging for a broad range of industries and the pandemic has been particularly difficult for the automotive industry as its supply chain is one of the most complex in the world. From the…

-

What is logistics in business

As we have explored as part of our recent series of blogs looking into the world of logistics, this is the industry that manages the acquisition, transport, storage and distribution of resources, typically on behalf of a third party client. While…

-

What is customs clearance?

Customs clearance is a mandatory process that all goods must go through when entering and leaving a country. In the UK’s case, custom clearance allows HM Customs & Excise to ensure the submission of export and import documents has been completed…

-

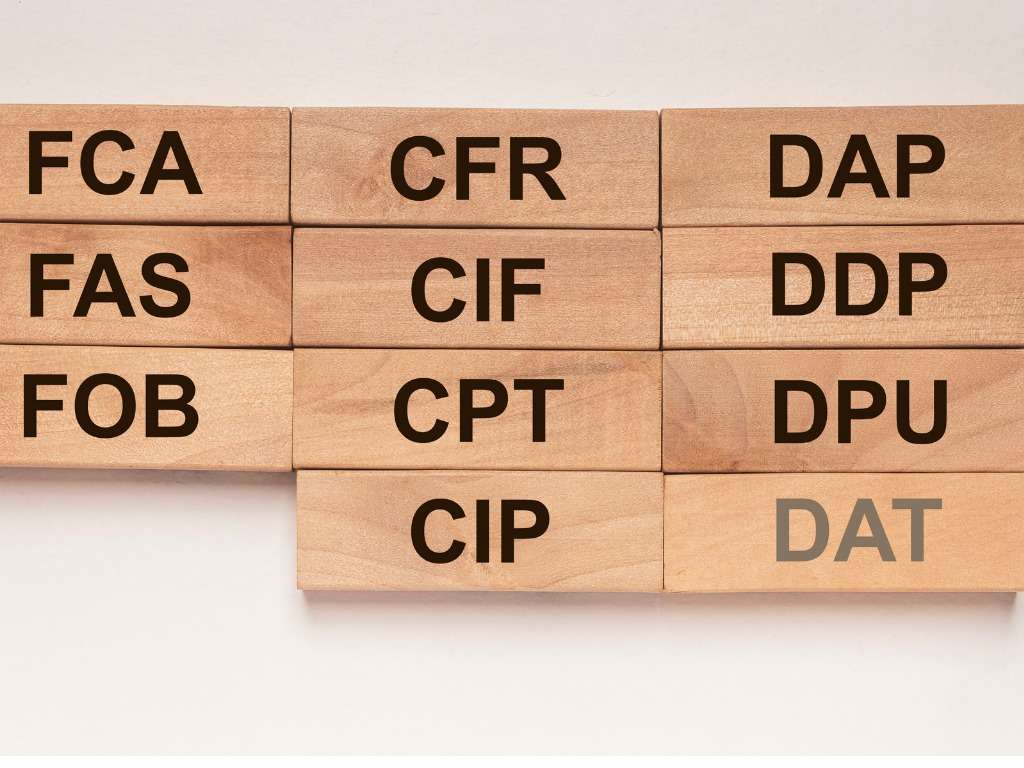

What are Incoterms?

Incoterms are an essential part of international shipping and customs clearance processes. From setting out who pays what to clarifying which party is responsible for the shipment at each individual stage of the journey, the international transport of goods requires a…

-

A bevy of black swans: are black swan events increasing in frequency and can you predict the unpredictable?

As the world becomes increasingly complex, the challenges encountered by the logistics and supply chain industry continue to mount. From globalisation and global warming to the COVID-19 pandemic and political instability, any business involved with the transportation, distribution and the…

-

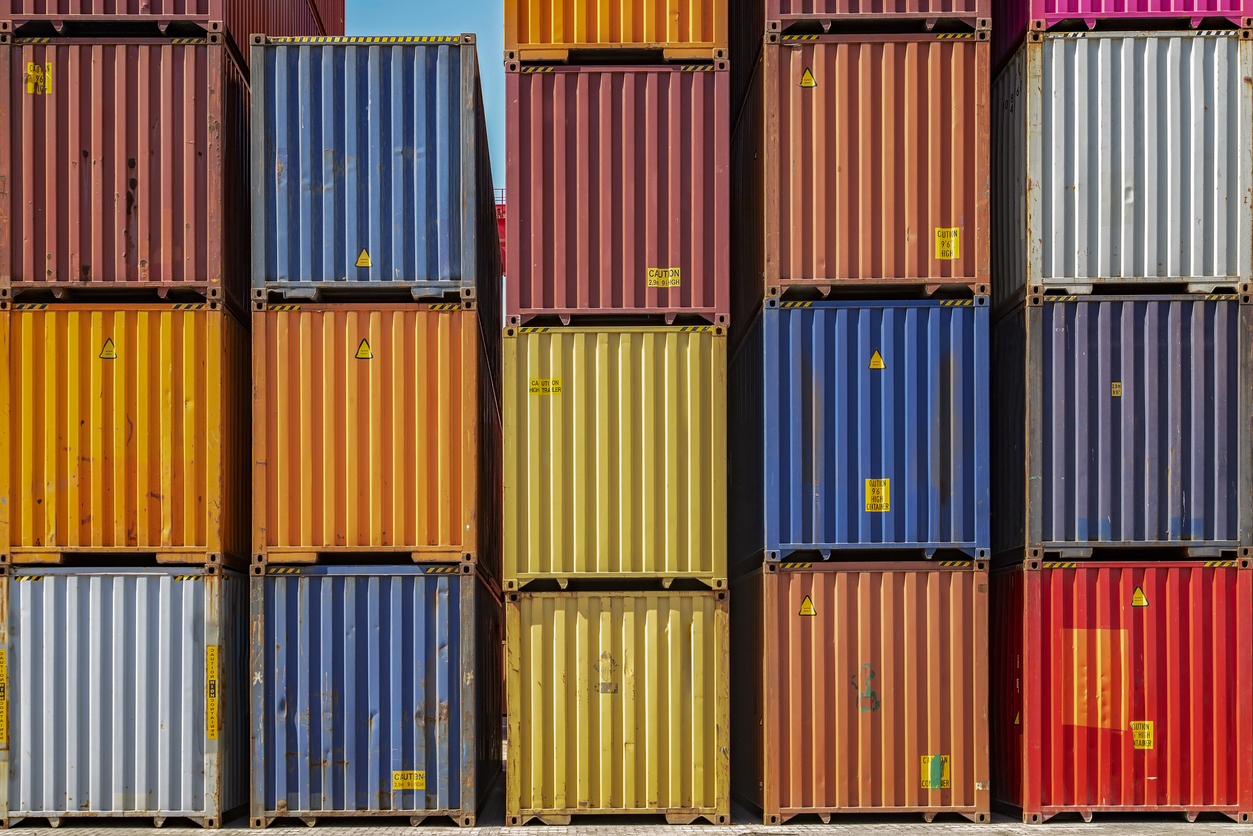

How to load and unload a shipping container

Prior to loading containers with goods, there are a number of important factors that need to be taken into account when shipping freight. To ensure no money is wasted, goods are not damaged and employees stay safe, it’s imperative that…

-

What is part load and full load?

For any business transporting goods between two locations, the cost of shipping can be expensive. As such, it’s important that they choose the most suitable haulage option as a method of cutting costs and maximising profits. One of the most…

-

What do third party logistics companies do?

According to research experts Gartner, over 80 per cent of professionals suggested that outsourcing logistics to third party companies was important and they would intend to increase their budget for doing this beyond solely fulfilment and warehousing. Likewise, 42 per…

-

What does logistics mean?

An umbrella term used to describe a huge global industry, in its most basic form, logistics is simply the process of planning and implementing the efficient movement, transportation, storage and distribution of goods, typically from one point of origin to…

-

What cannot be transported via air freight?

While it’s true that almost anything can be shipped from one location to another, including hazardous materials, when it comes to air freight, some restrictions are in place. This is simply because some items – be that explosive materials, flammable liquids,…

-

How to load a pallet for shipping

The key to running a successful road freight service is efficiency. From warehousing and distribution processes right through to delivery and returns, finding the quickest, safest and most cost-effective methods of operating is essential. This includes loading your trucks in the most…