What are Incoterms?

Incoterms are an essential part of international shipping and customs clearance processes.

From setting out who pays what to clarifying which party is responsible for the shipment at each individual stage of the journey, the international transport of goods requires a lot of complex planning and arrangements – Incoterms simplify this process.

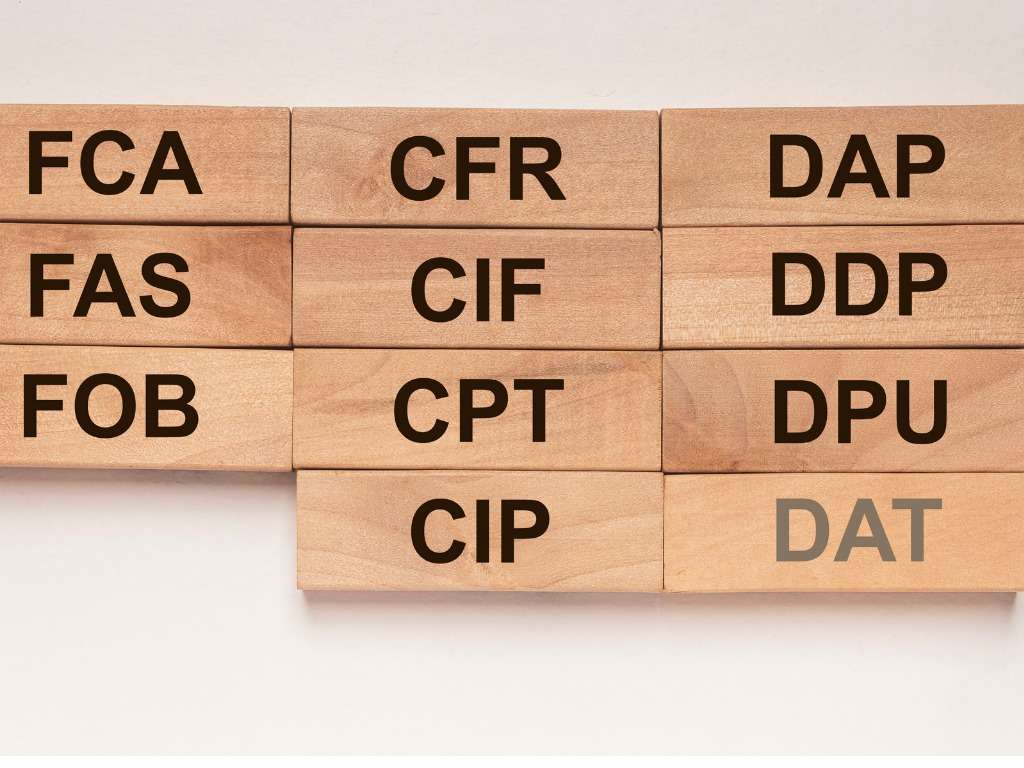

These universally used set of 11 recognised and accepted rules, which are represented using common acronyms, are used to define the responsibilities of both the sellers and buyers of a particular overseas shipment. However, if you are new to the world of international trade, these relatively simple sets of rules can appear confusing. With this in mind, here at Freightline, we have put together this handy guide to ensure you know exactly what to expect when dealing with Incoterms.

What does Incoterms mean?

The word ‘Incoterms’ refers to International Commercial Terms – a series of internationally accepted trade rules published by the International Chamber of Commerce (ICC).

As mentioned above, the purpose of these rules is to clearly set out the responsibilities of both buyers and sellers for the delivery of goods which are under contract and set to be shipped. This is to say they allocate the specific obligations, costs and risk-share between the two parties at each and every stage of a shipment’s journey. This information includes specific instructions relating to who is responsible for factors such as paying for and managing the shipment, documentation, insurance, loading/unloading, storage, customs clearance, and other logistical activities.

An Incoterm is typically presented as an easily identifiable three-letter acronym which can be quickly and efficiently recognised and understood by all parties involved in each stage of the shipping process. From specialist freight forwarders, such as Freightline, to customs agents and port staff, the Incoterm impacts all aspects of a shipment’s journey.

What are the different types of Incoterms?

There are 11 different types of Incoterms, which can be plotted on a scale ranging from those commercial terms that state the vendor is 100 per cent responsible for the entire transport of a shipment to ones which set out that the buyer carries all responsibilities for the goods during every stage of transit.

Below are brief descriptions of all 11 Incoterms:

- EXW (Ex Works)

This means the vendor must give the buying party complete access to goods at an agreed location. From the moment access has been granted and a location agreed upon, the buyer bears all costs and risks during the entire shipping process.

- FCA (Free Carrier)

An increasingly common delivery condition, here the seller must make the goods available at their own risk and expense at an agreed place. This means the seller is responsible for all export customs activity and other export activities. However, from delivery at a named port/terminal onwards, the buyer is responsible for all shipping obligations.

- CPT (Carriage Paid To)

Here, the seller has the same responsibilities as under FCA, however with the additional responsibility of having to pay delivery costs. This means the seller must organise customs clearance, ensure export fees are paid and arrange for a carrier to deliver the goods to an agreed location. After this point, the buyer takes responsibility for the shipment.

- CIP (Carriage Insurance Paid To)

This is the same as CPT, however here the seller is obligated to arrange and pay for cargo insurance. Like CPT, when CIP is used, the responsibility for the shipment shifts from seller to buyer when the seller transfers the cargo to the carrier.

- DAP (Delivered At Place)

With DAP, the vendor carries all the responsibility in terms of shipping costs and risk during the transport to an agreed address. However, this responsibility shifts to the buyer as soon as the goods have arrived and are ready to be unloaded.

- DPU (Delivered at Place Unloaded)

This means the seller is responsible for all costs and risks associated with delivering goods to an agreed location, as well as the process unloading for further transport.

- DDP (Delivered Duty Paid)

The vendor carries the cost and risk of transport and arranges all export and import tasks, including payment of VAT and duties. As soon as the shipment has been delivered at the location and is ready for unloading, the buyer takes on the responsibility.

- FAS (Free Alongside Ship)

The vendor bears all the costs until the goods are delivered to the port and are ready to be loaded onto the ship. After this, the buyer is responsible for the goods, including import/export customs clearance.

- FOB (Free On Board)

Here, the seller is responsible for the goods, including export clearance, until they are safely loaded onto the ship. Once the goods have been loaded, the buyer takes on all responsibility.

- CFR (Cost And Freight)

This is the same as FOB, however, here the seller must also cover the costs of transport to the port.

- CIF (Cost, Insurance, and Freight)

CIF dictates that the vendor has the same responsibilities as with CFR, however, there is the additional obligation of paying for basic cargo insurance. That being said, the buyer is responsible for paying for more comprehensive insurance policies.

Which Incoterm should I use?

Naturally, the Incoterm you choose will very much depend on a number of different factors. These factors include the nature of your goods, the method of transportation (road, sea, air or rail), who is insuring the goods, how well you know the buyer and more. For this reason, it is important that you fully understand the commercial arrangements you have in place with your buyer before deciding on an Incoterm.

FOB is the most popular Incoterm as it represents a relatively equal share of the risk for both buyers and sellers. However, if you are a more experienced importer, you may want to retain more control over the shipping process. In which case, EXW may suit your needs better. However, the most advantageous Incoterms for importers include DAT, DAP and DDP.